Bond yields still need to rise to set a price of capital that is sustainable for the world we’re in now.

If I could point to one price that matters most for the economy and financial markets, it’s the bond yield. It signifies how expensive it is to move from present to future: in a low-yield world, if you have money, you should consume now and not wait; if you have no money, you can get some by borrowing since it is virtually free. In a high-yield world, if you have money, you should save it because it will grow; if you have no money, it is difficult to get more because you must earn a high return in order to be able to pay it back. The bond yield is the relevant cost of capital, the baseline expected return of any longer-term financial investment, and the hurdle any real economic idea has to clear for profitability.

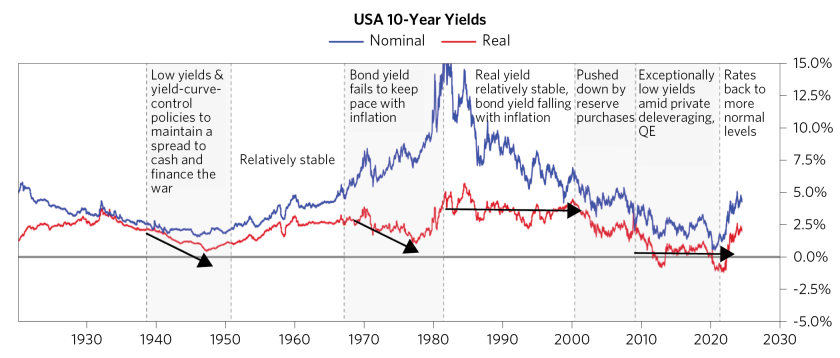

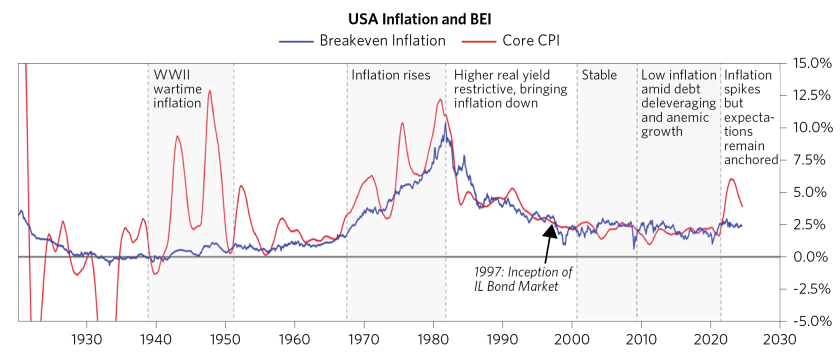

We’re in the midst of a transition from an exceptionally low cost of capital to more moderate levels. That process is underway but will likely take a few more years to fully complete. Bond yields still need to rise to set a price of capital that is sustainable for the world we’re in, compensating for structurally higher fiscal stimulation and inherently inflationary spending on things like AI investments, remilitarization, rebuilding supply chains to reduce reliance on China, the energy transition, and energy security.

What Sets the Cost of Capital?

The Fed, of course, plays a critical role in setting the cost of capital. The Fed sets the short-term interest rate and provides expectations for how its rate setting is likely to evolve over time. It is leading the shift: it shifted from a decade or more of making money free to seeing an economy that requires a new, higher cost of capital. Expectations of what the Fed will do over time anchor the bond yield: if the Fed ends up setting higher rates over time than the bond yield, investors will wish they held cash instead.

But the Fed and expectations of the Fed don’t ultimately set the bond yield on their own. At the end of the day, buyers and sellers of bonds must come together to form the price, and the Fed’s actions are one important element that weighs in the considerations of many (but not all) buyers. The composition of buyers and sellers can cause material deviations from the Fed’s current and expected future policies.

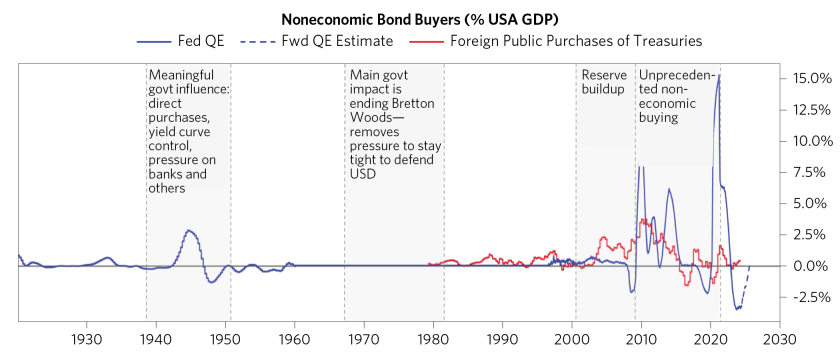

We lived through this prior to the financial crisis when China’s and OPEC’s desire to save in US dollars added a large group of lenders to the US that were not price-sensitive; they pushed the bond yield lower and lower, which incentivized borrowing, creating a bond yield that seemed inconsistent with how the Fed was likely to behave. This ended in tears with the global financial crisis, when some of those borrowers reached their limits, having borrowed too much.

Where We Are Today

We are coming out of a very long period when the price of bonds was largely set by noneconomic players. After the period of reserve accumulation mentioned above, we lived through over a decade when central banks intentionally dominated the bond market, with quantitative easing designed to shape policy outcomes by dramatically reducing the cost of capital and injecting printed money into the system. This era pushed many investors out of the bond market. Holding yields at zero was hard to justify relative to their return goals. Worse, the primary role bonds were supposed to play in a portfolio—of offsetting equity losses when the Fed eased in response to growth slowdowns—they couldn’t play very well when rates were close to zero already.

So, while the Fed has raised short-term rates (maybe to the max this cycle) and conveyed expectations of higher rates into the future than expected a few years ago, the process of transition and adjustment to a new cost of capital by buyers and sellers is not yet behind us. This is clear looking at the mix of buyers and sellers of bonds, which is not yet normalized. The bond yield has been range-bound around 4-4.75% for almost a year, and you can look at the buying and selling of bonds in this period as underlying this price formation.

At this phase in the cycle, years into a boom, there is usually a lot of borrowing to be absorbed, requiring rising yields. Today, despite an eye-popping federal deficit, total borrowing has been roughly normal (or maybe a touch low relative to the strong economy). Usually, the big borrower is the private sector, especially so long into a boom. Whereas today, yields are high enough to discourage the most rate-sensitive borrowing (e.g., mortgages). And many players have such healthy balance sheets and so much cash after a decade of deleveraging followed by COVID stimulus that they don’t need to borrow in order to spend (the chief example of this is the AI-related capex funded from cash flows and cash on balance sheets). But with massive federal deficit borrowing plus the Fed unwind of QE adding supply to the bond market, it still all adds up to a pace of borrowing that typically puts upward pressure on yields to keep drawing money into the market.

“Pent-Up Demand”

Bonds are nonetheless clearing at the roughly 4.5% yield levels we’ve seen. This is pretty low relative to the short-term interest rate of 5.5%, and even with expectations of some easing ahead of us, it is hard to argue there is much risk premium in that yield level (i.e., do buyers expect that the Fed will set rates on average well below this level such that bonds will outperform cash?).

Even 4.5% yields were sufficient to persuade bond buyers to begin to normalize their abnormally low bond holdings. This can be thought of as “pent-up demand” for bonds, which slows the process of adjustment to a new cost of capital. It’s less severe in the US than, say, in Japan (where every player sold all its bonds to the BoJ) but puts a lid on yields in the near term as players digest the fact that bonds offer acceptable (no longer negative in real terms) returns and can begin to play their traditional diversification role (i.e., the Fed can ease in response to an unexpected downturn).

As pent-up demand runs out and holdings of bonds start to normalize after years of decreasing, we’ll likely need another step up in the cost of capital to fund even this level of borrowing—which, as noted above, doesn’t include much private sector borrowing. And since conditions in the rest of the world have consistently lagged as US yields rise more than elsewhere, the differential grows, leading money to come in from abroad; this is another factor that is slowing the adjustment process to a higher cost of capital.

Keep in mind that many buyers don’t care about the level of yields as much as the steepness of the yield curve: they want to earn carry by borrowing to hold the bonds (e.g., banks that pay short-term rates on deposits and hold bonds with the money). The yield curve is inverted, discouraging these buyers. A small correction of Fed easing from these levels won’t change that. The bond yield needs to be higher than the short-term interest rate (and what the short-term rate is expected to be over time) to ensure it’s more profitable to lend over long periods and finance economic activity than to sit in cash. A normalized cost of capital includes a modest risk premium of this nature. When the Treasury borrowed to fund a large war effort in WWII, the Fed effectively promised a positive carry to get investors to buy. For large amounts of borrowing to clear, an upward-sloping yield curve will eventually be necessary.

Structurally Higher Spending Creates Upward Pressure on the Cost of Capital

Today, even a modestly slowing economy keeps us in what is effectively an unsustainable boom, with lots of desire to spend while the labor market and industrial base are tight. This backdrop is unlikely to change much in the coming months. The Fed is likely to ease a bit given its easing bias, which may add a bit more borrowing into the mix. Households and businesses will keep spending, because they’re spending from incomes and balance sheets. The federal government is likely to keep high spending no matter how the election goes, and there is even a chance of renewed stimulus providing a jolt of adrenaline when the economy is already revved up. Things will move up and down here and there, but what will remain is an underlying structural desire across government and the private sector to spend on inherently inflationary things: AI (near-term inflationary even if long-term deflationary), remilitarization, energy transition, energy security, and the rebuilding of the industrial base to be less reliant on China.

The cost of capital will need to adjust to be high enough to compensate for these drivers of demand and for structurally higher fiscal borrowing and stimulation, especially in an environment where small increases in the cost of capital probably won’t do much to slow the economy. There are mitigants in place slowing the process of transition, but bond yields likely still need to rise over time to set a price of capital that is sustainable for this reality.

Looking back over the last 100 years, the cost of capital was abnormally low in the decade leading up to COVID, supported by unprecedented noneconomic purchases. The transition to a higher cost of capital is now underway, but bond yields (especially in real terms) are still at the lower end of what we’ve seen without economic purchases to drive the cost of capital down and especially low relative to periods of structurally high demand (e.g., the last tech boom in the 1990s).

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, Bridgewater's actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. Any such offering will be made pursuant to a definitive offering memorandum. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular investment. The companies discussed should not be taken to represent holdings in any Bridgewater strategy. It should not be assumed that any of the companies discussed were or will be profitable, or that recommendations made in the future will be profitable.

The information provided herein is not intended to provide a sufficient basis on which to make an investment decision and investment decisions should not be based on simulated, hypothetical, or illustrative information that have inherent limitations. Unlike an actual performance record simulated or hypothetical results do not represent actual trading or the actual costs of management and may have under or overcompensated for the impact of certain market risk factors. Bridgewater makes no representation that any account will or is likely to achieve returns similar to those shown. The price and value of the investments referred to in this research and the income therefrom may fluctuate. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur. Investments in hedge funds are complex, speculative and carry a high degree of risk, including the risk of a complete loss of an investor’s entire investment. Past performance is not a guide to future performance, future returns are not guaranteed, and a complete loss of original capital may occur. Certain transactions, including those involving leverage, futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Fluctuations in exchange rates could have material adverse effects on the value or price of, or income derived from, certain investments.

Bridgewater research utilizes data and information from public, private, and internal sources, including data from actual Bridgewater trades. Sources include BCA, Bloomberg Finance L.P., Bond Radar, Candeal, CBRE, Inc., CEIC Data Company Ltd., China Bull Research, Clarus Financial Technology, CLS Processing Solutions, Conference Board of Canada, Consensus Economics Inc., DataYes Inc, Dealogic, DTCC Data Repository, Ecoanalitica, Empirical Research Partners, Entis (Axioma Qontigo Simcorp), EPFR Global, Eurasia Group, Evercore ISI, FactSet Research Systems, Fastmarkets Global Limited, the Financial Times Limited, FINRA, GaveKal Research Ltd., Global Financial Data, GlobalSource Partners, Harvard Business Review, Haver Analytics, Inc., Institutional Shareholder Services (ISS), the Investment Funds Institute of Canada, ICE Derived Data (UK), Investment Company Institute, International Institute of Finance, JP Morgan, JSTA Advisors, M Science LLC, MarketAxess, Medley Global Advisors (Energy Aspects Corp), Metals Focus Ltd, Moody’s ESG Solutions, MSCI, Inc., National Bureau of Economic Research, Neudata, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Refinitiv, Rhodium Group, RP Data, Rubinson Research, Rystad Energy, S&P Global Market Intelligence, Scientific Infra/EDHEC, Sentix GmbH, Shanghai Metals Market, Shanghai Wind Information, Smart Insider Ltd., Sustainalytics, Swaps Monitor, Tradeweb, United Nations, US Department of Commerce, Verisk Maplecroft, Visible Alpha, Wells Bay, Wind Financial Information LLC, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, and YieldBook. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability, or use would be contrary to applicable law or regulation, or which would subject Bridgewater to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridgewater® Associates, LP.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.